This Get Started step ensures your invoices and tax filing status are configured accurately on TalentDesk so your organization can access your details and easily file taxes at the end of the fiscal year

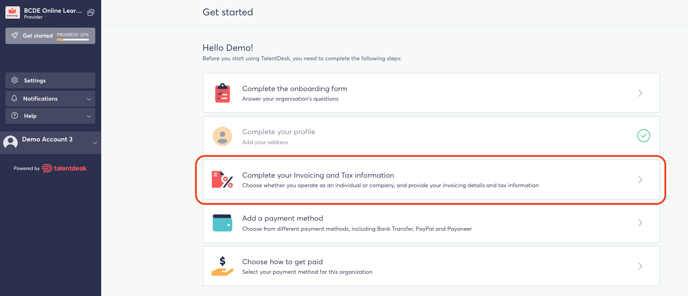

On your Get Started page, you will be prompted to Complete your Invoicing and Tax Information.

You will then be guided through several prompts to configure your TalentDesk account to accurately reflect your tax information and filing status.

The first question will determine if you are configuring your TalentDesk account as a legal or incorporated entity.

If Yes, than you will add your business details in the corresponding fields - Company Name, Address, and Tax Identification Number (TIN) are mandatory.

If you are reporting as an individual contributor, you will then indicate whether you are a US citizen or required to pay tax in the United States.

If you are a US citizen or required to pay tax in the United States, you will be prompted to enter your Full Legal Name and your Social Security Number.

We store this sensitive information securely and only share it with the IRS for 1099 tax filings. If you are a US citizen or taxpayer, you must choose yes.

Note: Your organization may have opted to make Tax Identification Numbers and tax form fields optional. If so, these fields will not be mandatory.

If you are not a US citizen or required to pay tax in the United States, you will be prompted to enter your Full Legal Name only.

All Providers will be required to indicate if they are registered to any regions with VAT, GST, or HST tax systems.

If Yes, then select which tax system and add your registered identification number.

If you are not registered in a region with VAT, GST, or HST you will select, No.

Finally, if you have indicated that you are a US citizen or required to pay tax in the United States, you will be prompted upload a tax form that represents your tax filing status (e.g. W-9, W-8BEN, W-8BEN-E).

When all of your details have been added and are accurate, click Update to complete the Invoicing and Tax Information step.

After you have fully onboarded to the platform, you can make changes to your tax information or update your tax form at any time from the Tax section of your TalentDesk profile.