California’s Freelance Worker Protection Act: What Businesses Need to Know

- 4 Feb 2025

- 2 mins read

- Posted in

Content:

California’s Freelance Worker Protection Act (FWPA), formally known as SB 988, took effect on January 1, 2025, ushering in new requirements for businesses engaging freelance professionals. With California joining states like New York and Illinois in implementing freelance protections, this legislation reflects a growing trend to ensure fair treatment of independent workers in the modern gig economy. Here's what you need to know about this landmark law and how it may impact your business.

Key Provisions of the FWPA

Mandatory Written Contracts

All agreements with freelance workers for services valued at $250 or more must be in writing.

Contracts should detail essential terms, including the scope of work, payment amounts, and timelines for deliverables.

Hiring parties must retain these contracts for a minimum of four years.

Payment Deadlines

Contractor payments must be made by the due date specified in the contract. If no due date is outlined, businesses are required to pay freelancers within 30 days of project completion.

Anti-Retaliation Protections

The law prohibits retaliation against freelance workers who assert their rights under the FWPA, such as requesting written contracts or pursuing unpaid compensation.

Freelancers can file legal claims against hiring parties for violations, and public prosecutors may intervene in certain cases.

Penalties for Non-Compliance

Businesses that fail to provide written contracts or timely payment may face significant penalties, including damages up to twice the unpaid amount or additional statutory fines.

Freelancers may also recover attorneys’ fees and other legal costs if they prevail in court.

Who Is Covered?

The FWPA applies to individuals or single-member entities engaged as independent contractors to perform professional services in California. Covered services include, but are not limited to:

- Marketing and public relations

- Graphic design and photography

- Writing and editing

- Translating and illustrating

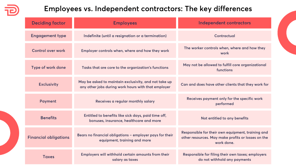

The law does not affect the criteria for classifying workers as independent contractors versus employees under California’s AB 5 and AB 2257 regulations, but businesses should remain vigilant about proper classification.

Why the FWPA Matters

The FWPA is a significant step toward fostering transparency and fairness in freelance work. By mandating written agreements and prompt payments, the law provides freelancers with greater security and clarity. For businesses, it highlights the importance of ethical practices and compliance in working with external talent.

Compliance Tips for Businesses

To ensure compliance with the FWPA, businesses should:

Audit Current Practices

Review agreements with freelance workers to ensure they meet the new requirements.

Establish clear payment schedules and processes to avoid delays.

Train Relevant Teams

Educate hiring managers, HR personnel, and finance teams on FWPA provisions to minimize legal risks.

Implement Contract Management Systems

Use digital tools to create, store, and track freelance contracts and payment schedules.

Review Classification Policies

Confirm that freelance workers are appropriately classified to avoid overlapping issues with AB 5 or federal employment laws.

The Bigger Picture

The FWPA aligns California with a nationwide movement to better regulate freelance work. New York City’s Freelance Isn’t Free Act and similar laws in Illinois and other jurisdictions demonstrate a growing recognition of freelancers’ contributions to the economy. As the gig economy continues to expand, more states are expected to follow suit, underscoring the need for businesses to proactively adapt.

If compliance is a concern when engaging freelancers, we're here to help. From classifying and verifying independent contractors to ensuring compliant engagement, our optional international Agent of Record (AOR) service acts as a protective shield for your business - giving you peace of mind. We provide a full contractor management system, giving you a central location to securely store documents and contracts, ensuring seamless compliance. Get in touch with us today to learn how we can support your freelancer compliance needs.

Stefani Thrasyvoulou

Tags

Speak to us to find out how we can help you stay compliant.

Related articles

What is a Contractor Of Record (COR)?

Discover the role of a Contractor of Record (COR) – Learn how a COR streamlines contractor compliance and safeguards your business legally.

The Hidden Complexities of Independent Contractor Classification

Read the complexities of independent contractor classification in our guide. Stay ahead with expert insights into evolving rules, tools, and future trends.

What are Global Payroll Providers: Understanding Payroll Systems

Explore the essentials of international global payroll, how it supports multinational operations, compliance, and simplifies payroll global processing.

How To Avoid Employee Misclassification

Avoid costly errors by learning about employee misclassification risks, legal ramifications and compliance strategies when classifying your workers.

Work, Reconstructed

Xenios Thrasyvoulou and Glen Hodgson discusses the main compliance issues that are faced today within the talent and HR sectors.

What is an Agent of Record (AOR)?

Read about the essential role of an Agent of Record (AOR) in representing freelancers and contractors globally, ensuring compliance and smooth operations.

Differences Between W9 and W8 Tax Forms

Unravel the purposes of W-8 and W-9 tax forms, download them, understand when and how to use them, and navigate the complexities of US tax compliance effectively.

How to pay 1099 employees

How to pay 1099 employees

Navigate 1099 employee payments and paying 1099 employees with ease. Learn how to ensure timely, compliant compensation for your contractor workforce. ‘

PEO vs. EOR: What's the difference?

Though similar, PEOs and EORs have key differences. Learn the distinctions and find out which is right for your business.

Freelancing and The Future of Work

Xenios Thrasyvoulou discusses shaking up the employment game, refreshing the tax rulebook, and removing the final hurdles to a super-flexible workforce.