Contractor Payments: Everything You Need to Know

- 23 Jun 2021

- 7 mins read

- Posted in

This blog was last updated: 11th of March 2025

If your organization has started working with more freelancers and contractors over the last year, you’re certainly not alone — over 61% of businesses are actually planning to increase freelancer engagements.

While most organizations acknowledge the importance of finding and managing external talent, they often overlook the crucial step that comes after — that of making timely contractor payments and using contractor payment system. Ignoring this can be quite a costly mistake, both literally and figuratively!

When independent contractors are not paid in an accurate and timely manner, they are likely to stop working for their clients. In an economy where businesses are all clamouring for the best talent, developing a reputation as a poor paymaster can make matters complicated. But there’s another consequence to be mindful of — payment delays can expose your business to legal disputes and disagreements, which can even impact your financial credibility in the future. There are several ways to optimize the payment process, such as using a payment portal to automate contractor payments.

Things to consider before choosing how to pay your contractor

Given these implications, it’s safe to say that it is pretty important to streamline contractor payments. But before you go about putting the right processes in place, there are a few important questions and considerations you will need to keep in mind before picking a contractor payment system.

-

Classification - are they contractors or freelancers?

Although ‘contractor’ is often used as a sweeping term to refer to any external worker, the correct legal classification is extremely important as it will dictate the payment process you need to follow.

Broadly, your contractors may be classified in two ways. Professionals who are self-employed (and whom you have engaged for a short-term requirement) may typically be classified as freelancers, independent contractors or 1099 contractors. These workers are in complete control of whom they want to work with, and are responsible for their own taxes, insurances, perks and benefits.

On the other hand, if you have engaged a skilled professional through an agency or an outsourcing company, and have booked their services for the duration of a longer term project, they may be classified as W-2 contractors. Though they are responsible for their own taxes, the outsourcing company they are working with may offer them some perks and insurance benefits. Do note that sometimes, contractors may own a limited company themselves, and enjoy greater control over whom they work with. This increases their similarities with freelancers, thus making classification a little more complex.

-

Taxes

Based on the classification, you will need to fill out different tax forms and documents for independent contractors or W-9 contractors. Make sure you have the correct details for all your contractors on record because any inaccuracies might result in hefty fines, either for you or for them.

For instance, if your independent contractor fails to give you their Tax Identification Number (TIN), or if you have the wrong one on file, you will need to hold back a part of their payment as backup withholdings. This is why having a streamlined onboarding process is so important — it ensures that you already have the correct details in place, long before you have to start making payments.

-

Number of contractors

If you are working with just one or two contractors, paying them manually may be simple enough. But this gets exponentially complicated as you bring more contractors on board. Verifying their timesheets, cross-checking their charges, carrying out the right documentations and maintaining accurate records for audits become very laborious over time. To add to this, each person’s contractor payment terms may stipulate different charges and methods by which they will need to be paid. Beyond a point, automating the payment process with a contractor payment system might be the smarter option, especially if you are planning to use contractors over the long term.

-

International contractors

This brings an added layer of complexity to the contractor payment process, especially when dealing with international payments. These transactions require extra bank authorizations, entail processing fees, and involve conversion charges. When working with global contractors on a larger scale, it becomes crucial to consider these factors. You might find it beneficial to opt for a payment process that facilitates easy and inexpensive international transactions to streamline budgeting and timeline management. -

Local (or domestic) contractors

For local payments, the process might seem straightforward in comparison to international transactions. Handling payments to domestic contractors generally avoids the complexities of bank authorizations specific to international transfers, as well as the associated processing fees and conversion charges. This simplification can make project budgeting and timeline management more manageable when working exclusively with local contractors. -

Frequency of payments

Here again, a one-time payment is easy enough to process manually — and even if it involves a high processing fee, that may not make a huge dent in your project budget overall. But seeing how most banks add a margin of 5-6% to the exchange rate, and processing invoices manually can cost you about $30 on an average for each invoice, these fees add up if you are paying the contractor(s) on a recurring basis. So setting up an automated payment process that minimizes recurring transaction fees might be a good idea.

Contractor payment methods

Depending on the considerations above, you may find that your contractor payments fall in one of two broad categories:

-

Weekly contractor timesheet cycle

This contractor payment schedule is typically adopted when you engage workers who charge on an hourly basis. In this case, the contractor will submit a detailed list of their hours to you for approval every week. Once you have verified and signed off on it, they will send you the weekly invoice, which you will need to pass on to your accounts department. If you are working with W-2 contractors, the invoice will not come from the workers themselves — their agency or outsourcing company will generate the invoice, and you will have to pay the company.

-

Monthly and direct payments

This method is more common with independent contractors who have per day charges or fixed-price contracts, rather than tracking their time on a weekly basis. Here, they will directly send you a detailed invoice at the end of the month, outlining the work done and the rate that was agreed upon beforehand. If the contractor has their own limited company, their invoices will include VAT as well. Here on, the process is pretty similar — you will need to check the invoice, approve it and send it to your accounts department to process the payment.

How to manage late payments

Despite best intentions, there are lots of reasons why your contractor payments might be delayed. This is especially true if you’re handling these payments manually. Checking and approving every contractor’s timesheets can be arduous and can create bottlenecks as your managers struggle to process them all. Moreover, with several contractors reporting to different managers, there’s always a chance that one or two invoices go astray. Locating these across various inboxes or asking contractors to send them again might take time. The accounts team might also need a few days to clear all the invoices. Even after this, you may have to factor in bank delays in case you’re using cheques or direct transfers.

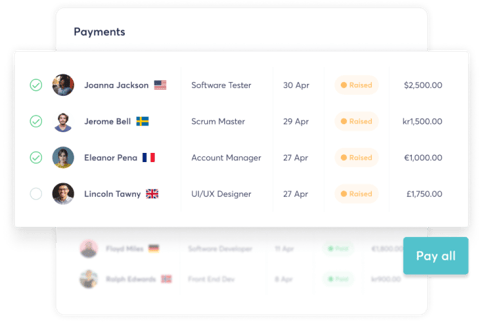

The trick to minimising these delays is to automate as many steps as you can with a contractor payment system or portal. A good payment portal helps you streamline some of these processes, thereby reducing the scope for manual delays and human error. TalentDesk, for example, allows contractors to raise worksheets against each task — which your managers can easily cross check and approve with a click. There on, the system consolidates all approved worksheets and generates a single invoice, thus ensuring that your accounts team is not inundated with hundreds of individual invoices to process. Once the contractor payment is made, the system will also disburse the correct amounts to individual contractors, automatically following a set payment cycle.

5 best ways to pay contractors

Once you have considered all the factors involved and have ascertained the payment cycle you will have to follow, it’s time to decide how to pay your contractors. There are lots of options to choose from, but here are some of the most common ways to pay freelancers:

-

Online payment portals

Portals like TalentDesk, PayPal, Wordlpay and Wise function as great contractor payment systems because of how fluid and versatile they are. A contractor payment system or portal usually enable you to make both domestic and international transfers easily, and have shorter processing time when compared to banks. When it comes to conversion rates and processing fees too, they work out to be much cheaper than traditional methods. However, not every portal works in every country, so do consider which countries your contractors are based in and ensure that the online system is supported in that geography. A tool like TalentDesk, which facilitates contractor payments in 150+ countries (through partnerships with various providers including Wise, Worldpay and Payoneer) is an easy choice when you want to pay freelancers.

-

Cheques

This is an easy, traditional way of making contractor payments as it requires no elaborate implementation — you can simply write a cheque and mail it to the recipient. However, in the modern context, it might not necessarily be the best option as it does not work for international talent. Some local contractors may also refuse to accept paper cheques, especially if they haven’t worked with you before. This is because cheques can be slow to arrive, have the risk of getting lost in transit — and of course, there’s always the chance that they might bounce.

-

Credit card

Credit card payments are much faster and a lot more secure. It doesn’t expose your account details unnecessarily, and most banks offer increased layers of security to guarantee safety. However, for this mode of payment to work, your contractor will need to have a merchant account or set up a payment gateway through some app.

-

Electronic Fund Transfers (EFTs)

This refers to transferring money directly to your contractors’ bank accounts. This method (otherwise known as wire transfer or bank transfer) is quick and easy and is preferred by both independent contractors and clients. It requires no system set-ups, and if you already have your bank’s app, you may be able to make transfers seamlessly from your phone. The downside to this contractor payment method however, becomes more obvious when you are making international transfers. Bank conversion rates are not the most lucrative, and they usually charge high processing fees, both at your end and at the recipient’s.

-

Accounting software

Accounting software helps you keep track of project budgets and expenses, but some tools also have features that facilitate invoicing and payments. These tools usually link every invoice to specific ongoing projects, and record all the payment details for audits. This gives you a more comprehensive solution, allowing you to handle several aspects of accounts and finances with a single software. If you work with many international contractors on a fairly regular basis, this might be a great option for you.

KYC/AML checks are essential before payments

Before initiating your first payment, it's crucial to conduct a Know Your Client (KYC) verification. This process is vital when sending funds to independent contractors, as it ensures the validation of their identity beforehand. The term KYC is often used interchangeably with AML, which refers to 'Anti-Money Laundering,' highlighting the importance of these procedures in preventing financial crimes.

How to choose the best contractor payment system

With so many great options in the market, choosing the right contractor payment system for paying your contractors might seem daunting. However, if you take all these aspects of contractor payments into consideration, you will soon be able to prioritise the features you really need, based on the way your organization operates.

Check out our infographic for a quick overview of our payment process 👀

An end-to-end system like TalentDesk is a great option because it brings together several crucial features within one platform. Not only does it function as an automated payment solution that supports multiple ways to pay contractors and freelancers (Payoneer, Paypal, Wise, Worldpay and more) it also has various onboarding, time tracking and work allocation capabilities, which are extremely important when it comes to working with contractors. This eases the process substantially and enables you to optimise the benefits of having freelancers and contractors as a part of your team.

Sanhita Mukherjee

Tags

Speak to us to find out how we can help you pay your contractors more efficiently

Related articles

Effective Budget Management for Freelance Projects

Effective Budget Management for Freelance Projects

Discover how mastering freelance budget management prevents cost overruns. Control hidden fees, automate payments & boost financial visibility.

Integrating Accounting Systems with Freelancer Platforms

Integrating Accounting Systems with Freelancer Platforms

Read how integrating freelancer platforms with accounting systems transforms your operations. Streamline payments, compliance & gain real-time visibility.

What are Global Payroll Providers: Understanding Payroll Systems

Explore the essentials of international global payroll, how it supports multinational operations, compliance, and simplifies payroll global processing.

How to pay 1099 employees

How to pay 1099 employees

Navigate 1099 employee payments and paying 1099 employees with ease. Learn how to ensure timely, compliant compensation for your contractor workforce. ‘

How TalentDesk Uses Wise Business to Pay Contractors Abroad

How TalentDesk Uses Wise Business to Pay Contractors Abroad

TalentDesk's case study for Wise Business discuss how we make paying contractors and freelancers abroad simple with the help of Wise. Learn more here!

Our Top 12 Systems to Pay Freelancers

Our Top 12 Systems to Pay Freelancers

Are you looking for a reliable freelancer payment solution to automate your payments? Find the best freelancer payment portal & start attracting top talent