How to pay 1099 employees

- 13 Dec 2023

- 10 mins read

- Posted in

Content:

What do we mean by 1099 employees?

Before you begin: 3 things to keep in mind

What are the most common 1099 payment frequencies?

What are the most common 1099 employee payment methods?

What other payment agreements should a business consider?

1099 employee payments: As simple as you make it

A project that needs to be executed in a different country. A task with a tight deadline that requires the skills of a senior professional. A one-off project. Most businesses today have varied requirements like these – and the agility and flexibility with which they are able to meet these needs often determine their success.

Working with 1099 employees is an easy way to tackle such requirements. In fact, it is often easier than bringing an employee on board!

What do we mean by 1099 employees?

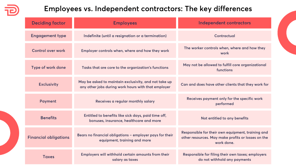

First, let us clear up any confusion about this term. 1099 employees are not really ‘employees’ of your company. In fact, you may have heard several similar terms being interchangeably used – 1099 employees, 1099 contractors, 1099 workers. In reality, all of these refer to the same category of workers – they are all independent contractors.

These terms are a reference to the tax form (Form 1099-NEC) employers in the US have to submit when they work with independent contractors. We have explained the tax intricacies in greater detail in the penultimate section of this blog.

Employers prefer working with 1099 employees to meet varied requirements because these professionals can be hired and onboarded faster and they can hit the ground running. Paying them is also simpler because there are no benefits, overtime payments or taxes to account for.

Easy though the process of paying 1099 employees is, there’s still a right way and a wrong way to do this. The wrong way is essentially when you go about it without an organized process – for example, when you only have a verbal agreement about the amount to be paid, make payments off the books, and don’t keep track of how much you paid which worker. As you can imagine, this has the potential to create endless confusion.

So what’s the right way to pay your 1099 employees? That’s exactly what we will discuss here.

Before you begin: 3 things to keep in mind

- Classify your workers right.

This needs to be done before you make the first payment to your 1099 contractors, because this will have an important bearing on how much you pay them and how. As we mentioned above, you do not need to offer benefits, make overtime payments or handle tax deductions for your 1099 employees.

But do ensure that the workers in question are indeed 1099 employees – and not incorrectly classified employees. If they are the latter, withholding benefits and not following tax protocols can invite legal trouble! - Sign a contract

Signing a formal agreement is another important step. The contract should be a watertight document that, aside from the scope and ownership of the work, also outlines every detail about the payment process – including the amount to be paid, payment milestones if any, invoice frequencies, payment methods and more. - Collect the right documentation

You will also need to gather the right forms and get them filled and signed by your freelancers and contractors before the engagement begins.

The required paperwork differs from country to country. In the US, the relevant document to have on file is the W-9 Form, which records crucial details about the contractor – like their legal name, their Taxpayer Identification Number (TIN) and more. Don’t forget to store this form for at least 4 years after the engagement, just in case there are any audits or IRS queries later.

Need more information to make sure you are classifying your workers correctly? Check out the key differences between W-2 and 1099 workers.

What are the most common 1099 employee payment frequencies?

So, how do you pay a 1099 employee? Since your 1099 workers are not your company’s employees (also known as W-2 employees), you will not be paying them a regular amount each month. But there are several other payment frequencies you can consider. What you choose depends on your workers’ preference, your company’s systems and what makes sense for the task to be performed.

There are typically 3 ways to pay 1099 employees and how 1099 workers prefer to be paid.

Hourly payments

This is one of the most common ways to pay 1099 contractors or freelancers. They will quote an hourly rate, and if that works for you, you sign the contract and bring them on board. Once the project or task is complete, they will send you a detailed invoice outlining how many hours they’ve spent working on it. The number of hours multiplied by their hourly rate is what you will need to pay them. Keep in mind that they are charging you for their expertise, so the more experienced the worker is, the higher their hourly fee.

If not planned well, this can send your costs spiraling. After all, what do you do if the number of hours the contractor bills you for is more than what you had anticipated? The key to avoiding such conflicts is to have a transparent discussion with the worker before you begin.

An experienced 1099 employee should be able to give you an estimate of how many hours a task will require (give or take a few hours). As long as the brief is clear and the scope of work doesn’t change drastically, their estimate should be accurate. You can also take additional steps like setting a cap on the number of hours you are willing to pay for. Once you’ve reached an agreement with the worker, put all of these details in your contract.

Don’t forget – while you have a say on how many hours a 1099 employee works for you, you cannot dictate which specific hours they’ll be. You only have that control with your W-2 employees.

Per project cost

Rather than an hourly breakup, many 1099 employees prefer to charge per project. Here, they will first discuss the scope of the project with you in detail, to ascertain exactly how much effort will be involved. They will then quote their rate for the project based on that understanding. If this works for you, you’ll simply need to pay them this agreed-upon amount once they send you their invoice.

The total number of hours they spend will not have an impact on how much you are required to pay. However, if you change the scope of work to an extent where the initial estimate of the effort involved no longer holds true, you may incur extra charges – think of instances where the brief changes or you require them to redo the work due to reasons you had not communicated before.

Typically, the 1099 employee will send you the invoice once they have delivered the tasks to your satisfaction. But for larger projects, they may prefer to have payment milestones. For example, if you are looking to get a new website designed, the contractor will need to put in a significant amount of time and effort to get that done. In these cases, they may require a percentage of the payment to be made in advance, charge you another portion of the payment halfway through the project, with the final installment to be paid at the very end. This protects them from clients defaulting on payments once they’ve got their work done.

Every payment term, be it extra charges or payment milestones, will need to be discussed before you sign the contract. This is crucial in order to avoid unwelcome surprises, both for you and for the 1099 employee.

Retainer

The nature of some tasks may be such that you require the services of a 1099 employee on a recurring basis. For example, a freelance marketing manager you engage to execute all your campaigns or an accountant you have on contract to handle your finances through the year. In these cases, it might make sense to sign a retainer agreement with that worker.

Under a retainer, you agree to pay them a certain amount on a monthly or quarterly basis. In exchange, the contractor or freelancer takes on all your requirements during that period.

Of course, communication and transparency dictate the success of retainer engagements. The 1099 employee will work with you to decide upon the kind of tasks to be covered, determine foreseeable periods of peaks and troughs and more. If done right, retainers offer immense stability to both parties – you get the benefit of having a trusted worker on board, and the 1099 employee gets to enjoy a steady income.

What are the most common 1099 employee payment methods?

Once you’ve agreed upon the payment frequency, you will also need to ascertain how to pay employees 1099. You have different options available to you.

Bank transfer

This is a very straightforward payment method where you simply make a direct deposit to their bank. Most people are already familiar with this process so all you’ll need are basic details like their bank account number, account type and bank identification codes like IBAN or SWIFT code. However, this is not the most convenient payment method in every situation.

If you are working with freelancers and contractors on an ongoing basis, you will need to make recurring payments – and will be charged a bank fee each time. Depending on the bank and the country, this fee can be quite steep, which adds up over time. The issues get amplified with international bank transfers – with expensive fees, significant payment delays and exorbitant currency conversion rates.

Money orders

This is another straightforward method where you make your payments through money transfer services like Western Union or MoneyGram. The process is simple enough – you will need to purchase the money order and it will be sent to your recipient. This is a great way to pay workers around the globe.

While the lower processing fees and better currency conversion rates often make these better alternatives to bank transfers, you still have to contend with a long payment process. There is also a limit to how much you can send through a single money order – you cannot send more than $1000 at a time, making this an unsuitable option for larger projects. Do keep in mind that the recipient also needs to be an approved user before you can send any money.

Payment orders

Payment platforms like TalentDesk (which facilitates payments through Wise), is quickly emerging as the easiest solution today. These platforms are designed to make payments to several 1099 employees on an ongoing basis, thus driving significant time and cost efficiencies.

Here, you add your 1099 contractor payment details when you onboard them. Once the contractor has delivered the work and raised their invoices, you can approve payments with a click. The payment platform will then disburse the payments to your freelancers and contractors around the world at nominal charges. Most platforms offer payment capabilities across various countries and currencies.

With a tool like TalentDesk, the process is simplified even further. The system tracks and consolidates all approved invoices and generates a single bill for you to pay every month. The payments get disbursed to all your 1099 workers as per the payment frequency you choose. This means you won’t even have to process payments individually. The amount is credited to your workers almost immediately, thus making the process fast and easy.

What other payment agreements should a business consider?

If the scope of work is clear and precise and the briefing process is done right, there shouldn’t really be any issues at the payment stage. However, there are a few situations you might want to protect yourself against.

Incomplete work

Most professionals will ensure that the work is delivered to your satisfaction – but in rare circumstances, you may find that a contractor has turned in a project half done, or has abandoned it halfway through. While you cannot control how they work, you do have a say over the final results a contractor delivers.

When you send them the agreement, set out tangible deliverables and solid KPIs they need to meet before the work is considered complete. You can add in monetary liabilities if the agreed upon parameters are not met – you may be within your rights to withhold payment or a portion of the payment until the work is delivered in full.

However, do ensure the KPIs are fair and reasonable. Your website designer, for example, cannot be expected to guarantee a certain number of page visitors or conversions. Also, once a freelancer delivers the work discussed, make sure you review and approve them in a timely manner. If feedback is not provided within a reasonable timeframe, the freelancer may (rightfully) consider the work completed and raise their invoice.

Late delivery

Experienced 1099 employees will always insist on reasonable timelines and ensure they have all the information they need before they begin. There on, they will plan their work in a way that honors the deadlines they have agreed to. They will likely also keep room for human error or unforeseen circumstances to ensure any unplanned delays do not impact the project timelines.

You can mutually agree upon penalty clauses in the contract, where they will need to pay a fine or forgo a part of their payment in case they fail to meet the deadlines decided. Aside from this, also discuss how you will go about setting new deadlines so that they are able to deliver the work promised.

Revisions required

This largely depends on the brief provided – the clearer your ask, the better will be the quality of the work you receive. Ideally, it will be up to the standard where it gets approved in one shot. However, depending upon the nature of their business, many 1099 employees offer one or two rounds of revisions where you can request minor changes or edits. Any revisions beyond this may incur extra costs.

But if you are not satisfied with the work even after these iterations, you will need to investigate what went wrong – and your findings will impact your project costs. If the issue is found to be at the contractor’s end, most professionals will take accountability and agree to revise the work at no additional cost.

If, on the other hand, the gap is found to be at your end as the client (perhaps a wrong brief or inadequate information provided), the 1099 employee will be within their rights to refuse further revisions. As per the contract, you will then be required to pay them in full as they have fulfilled their obligations.

Tax rates for 1099 employees

When it comes to taxes for 1099 workers, your responsibilities are not as extensive as for your W-2 employees. You do not need to withhold any amount, deduct any FICA payments or file any unemployment taxes on their behalf. Since 1099 employees are self-employed, these responsibilities are their own.

The taxes contractors pay differ depending on where they are based. In the US, this comes up to about 15.3% – including 12.4% for Social Security payments and another 2.9% for Medicare. They may also need to pay some additional state or local taxes.

Do note – while you do not need to file these taxes or withhold any payments from your 1099 workers, you still have to record payments made to them. In the US, if that amount exceeds $600 in a year, you will need to fill out a Form 1099-NEC and submit it to the IRS by the end of January of the following year. You will need to send a copy of this form to the contractor too.

This is for your contractors based in the US. If they are based in other countries, you will have to fill the Form W8-BEN instead. If your business is based in a different country, don’t forget to find out and adhere to the local tax protocols.

1099 employee payments: As simple as you make it

So as you see here, paying 1099 contractors is not too complicated at all. In fact, much of the heavy-lifting is done before you pay out a single dollar. As long as you’ve onboarded them right, gathered all the right documents and had the right conversations beforehand, the payment process will be a breeze.

To make 1099 documents even easier to understand, check out our blog 'What is a 1099 form and how to prepare and file it?'.

What’s more, with the right tools at your disposal, you can automate much of the process. A platform like TalentDesk is designed to streamline contractor payments, end-to-end. The customized onboarding step ensures that all the right forms are gathered and nothing falls through the cracks. The documents are then stored securely and compliantly in the cloud. There on, we have discussed how our system eases the payment process by consolidating invoices and disbursing payments around the world. It also generates audit trails with every payment made, making those tax or accounting assessments stress-free.

This essentially means that you get to enjoy all the efficiencies of a truly automated process, while retaining all the control you could wish for.

Sanhita Mukherjee

Speak to us to find out how we can help you pay 1099 employees (contractors) efficiently

Related articles

What is a Contractor Of Record (COR)?

Discover the role of a Contractor of Record (COR) – Learn how a COR streamlines contractor compliance and safeguards your business legally.

California’s Freelance Worker Protection Act: What Businesses Need to Know

Learn how California’s Freelance Worker Protection Act (FWPA) impacts your business with compliance requirements, payment rules, and penalties.

The Hidden Complexities of Independent Contractor Classification

Read the complexities of independent contractor classification in our guide. Stay ahead with expert insights into evolving rules, tools, and future trends.

What are Global Payroll Providers: Understanding Payroll Systems

Explore the essentials of international global payroll, how it supports multinational operations, compliance, and simplifies payroll global processing.

How To Avoid Employee Misclassification

Avoid costly errors by learning about employee misclassification risks, legal ramifications and compliance strategies when classifying your workers.

Work, Reconstructed

Xenios Thrasyvoulou and Glen Hodgson discusses the main compliance issues that are faced today within the talent and HR sectors.

What is an Agent of Record (AOR)?

Read about the essential role of an Agent of Record (AOR) in representing freelancers and contractors globally, ensuring compliance and smooth operations.

Differences Between W9 and W8 Tax Forms

Unravel the purposes of W-8 and W-9 tax forms, download them, understand when and how to use them, and navigate the complexities of US tax compliance effectively.

PEO vs. EOR: What's the difference?

Though similar, PEOs and EORs have key differences. Learn the distinctions and find out which is right for your business.

Freelancing and The Future of Work

Xenios Thrasyvoulou discusses shaking up the employment game, refreshing the tax rulebook, and removing the final hurdles to a super-flexible workforce.