What is a Contractor Of Record (COR)?

- 4 Mar 2025

- 9 mins read

- Posted in

Contents

- Defining Contractor of Record (COR): Roles and Responsibilities

- The Importance of COR in Freelance & Contractor Management

- How a Contractor of Record (COR) Works

- Benefits & Drawbacks of Using a Contractor of Record (COR)

- Understanding COR Agreements: What You Need to Know Before Signing

- Streamlining processes with COR

Defining Contractor of Record (COR): Roles and Responsibilities

A hyper connected global economy doesn’t just offer business opportunities at an international scale – it also opens up incredible talent opportunities. The possibilities are virtually endless!

Want to put together a capsule team halfway around the world? No problem! Looking to invite five different SMEs from diverse fields and different geographies to collaborate on a special project? Anytime! Want to set up a new business entity in a country without ever having set foot there? A few strategic calls and emails – and you’re done!

As an employer, these opportunities are certainly not something you want to miss out on. But this also throws up challenges at a global scale. Now, you will need to consider factors like labor laws across different countries, global compliance, international payments and more. In this blog, we’ll explore how you can solve all these challenges in one full swoop.

What is a Contractor of Record (COR)?

Enter – a Contractor of Record (COR). This is a third-party provider that eases these global challenges.

They do this by assuming your legal, compliance-related and payment-related admin responsibilities of working with contractors – and handling all operations on your behalf. Additionally, a COR also acts as a shield, protecting you against misclassification charges. Essentially, they take full liability of all matters related to contractor compliance, giving you complete peace of mind.

How a COR Differs from AOR (COR vs. AOR)

%20vs.%20Agent%20of%20Record%20(AOR).png?width=700&height=394&name=Contractor%20of%20Record%20(COR)%20vs.%20Agent%20of%20Record%20(AOR).png)

If you have heard of Agent of Record (AOR) services, you may be wondering at this point how a COR is any different. A Contractor of Record (COR) is actually a type of AOR service – and the two terms are often used interchangeably.

An AOR was originally a term used for any intermediate entity that functioned as a go-between for an employer company and a group of professionals that they work with. Their purpose has always been to ease certain business functions for the employer, while ensuring that the workers benefit from smooth operations.

AORs were initially more common in the insurance space. Employers would engage an AOR to step in, negotiate with various insurance providers to get the best possible coverage for the company’s employees – and then also disburse those insurance benefits to their employees. Here, the AOR’s main responsibility was to ensure that employees get the benefits they are entitled to without any hitches.

AOR services also became common in the construction space. In this case, they would mediate between the employer and the various construction professionals they were working with. The AOR’s key responsibility here was to ensure compliance, pay the workers and uphold all the safety codes and construction laws that the employer may not be aware of.

Soon, any intermediary service came to be known as an ‘AOR’. Over time, with the rapid growth of the freelancer and contractor ecosystems, a new type of AOR service emerged called the Contractor Of Record or COR – a service specifically for managing contractors.

➡️ For the differences between Employer of Record (EOR) and Agent of Record (AOR) - read our full blog.

Key Duties of a Contractor of Record (COR)

Just like in the construction and insurance spaces, here, a COR’s key responsibility is to function as an intermediary between employers and global contractors. They handle the operational side of engaging and working with independent contractors – from onboarding them to classifying them, managing records, disbursing payments across countries and more.

Additionally, they handle the more legal and regulatory aspects of the engagement. This includes helping the employer adhere to the labor laws across different countries, managing compliance based on the changing rules, and also ensuring the employer doesn't inadvertently cross a line that may cause the workers to be termed as an employee.

The Importance of COR in Freelance & Contractor Management

Ensuring Legal & Tax Compliance Across Borders

This is particularly important in the freelancer and independent contractor space and it’s one area that many employers often struggle with. That’s because talent and labor laws are always changing.

For example, in New York, the Freelancing Isn’t Free Act (FIFA) was recently revised to include new protections for freelancers. Under this, employers are required to define their engagement with a freelancer through a written contract, if the amount paid to them exceeds $800 in a 120-day period. This means employers will now need to transparently track payments made to freelancers and execute contracts using approved templates.

Similarly, policies around how contractors are to be taxed and what paperwork an employer will need to file are also changing frequently. These complexities are only compounded when you consider the fact that each country (or state) has unique laws. That’s why it is so helpful to have a Contractor of Record (COR) handling these on your behalf – keeping you up-to-date on these changes and notifying you of any implications that may affect your freelancer engagements in any location.

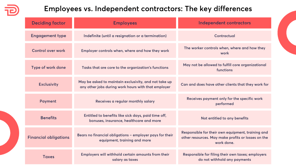

Reducing Risks of Contractor Misclassification

Classifying workers is another unique nuance of freelance and contractor engagements. In more traditional industries like construction, for example, it is easy enough to ascertain who is a contractor.

But in modern corporate environments, the distinction gets blurry – a freelancer may often work in much the same way as, say, a permanent member of your staff who works remotely. This puts you at risk of misclassification – imagine thinking you are just hiring a freelancer in a different country, only to find out that the way you are working with them actually makes them your employee!

This may involve costs that you had not accounted for – from steep misclassification fines to back pays and employee benefits. This is where a COR proves invaluable.

A COR will know the ever-changing classification protocols that define who is an independent contractor and who will be termed as an employee. They will know the differences in these regulations across different countries and help you manage your day-to-day activities ensuring you do not cross the thin line between the two categories of workers.

Streamlining Global Payments & Administrative Workflows

Another specific intricacy of working with a global hybrid workforce is the payment complexities it involves. Working with many freelancers and contractors around the world means you receive separate invoices from each worker – all of differing amounts, in different currencies and at different times!

Trying to manage payments can quickly get challenging. A COR helps you navigate this by taking over your payment responsibilities completely – disbursing payments as relevant, and on time. This offers huge advantages in terms of avoiding payment errors, delays and hefty bank fees.

Additionally, a COR also takes over various admin responsibilities like updating contractor documentation when required, conducting compliance reporting as per the tax deadlines of different countries and more.

Do you need help with automating your freelancer payments?

How a Contractor of Record (COR) Works

How you engage with your Contractor of Record providers in the first place, will set the tone for how beneficial you will find their services. Here are a few things to keep in mind.

The COR Onboarding Process

First up, review all your options to ensure you are choosing the right COR for your needs. Not all COR services are made equal – some of them may not service the countries you wish to engage workers in, or be able to handle the number of workers you want to bring on board. Have detailed conversations with the relevant COR representatives to understand their true capabilities. It also helps if you choose a provider that has experience within your industry.

Signing a service agreement is another key part of the COR onboarding process. This will formalize the responsibilities and capabilities you would have already discussed with the COR representative. It will also help you set the right expectations about what the COR providers will handle. For example, they will usually offer onboarding, administrative, payment and freelance compliance services – but will not perform any project management tasks. It will be up to your managers to collaborate with the freelancers and direct them on the work to be done.

Handling Compliance, Taxation, and Payroll for Contractors

Next, get into the logistics of the COR workflows. For example, you should be aware of how exactly they will handle freelancer onboarding, what software they will use to gather information and what your obligations as an employer will be. Also establish how they will work with you to ensure ongoing compliance.

When it comes to payment workflows too, ascertain what their process will be. Everything from how they will bill you to what payment timelines will be followed should be clearly discussed.

Similarly, find out how they will manage taxation – verifying what kind of freelancer documentation they will file and how. At this point, also make sure you send them all the employer information they will need – like your company registration details, employer ID or anything else.

This may all seem like a lot – but keep in mind that these are just some initial, one-time discussions. Establish all these processes early on and you’ll be able to enjoy smooth operations going forward!

Offboarding Contractors Legally & Smoothly

Offboarding contractors properly is just as important as onboarding them right! There are some protocols that need to be followed, which employers often miss.

For example, once a freelancer’s contract is up, it is crucial to ensure that their access to your organizational data and systems is revoked. This protects your IP and other sensitive information. Similarly, all invoices will need to be cleared, making sure there are no outstanding payments to cause friction later. Your COR should be able to step in and perform these tasks.

Don’t forget to consider the interpersonal side of offboarding – like thanking your freelancers and contractors, and making them feel appreciated for their contributions. After all, you would wish to part on a good note and maintain a professional relationship so you can reach out to them again. Your COR will be instrumental in handling all these processes right – especially, when it comes to mediating on language and local customs.

Benefits & Drawbacks of Using a Contractor of Record (COR)

Pros of Using COR Services

As we have seen so far, the benefits of bringing a COR on board are innumerable. For companies that have used Contractor of Record (COR) services, the greatest advantage they report is the assurance and peace of mind they get to enjoy. Oftentimes, employers hesitate to engage international contractors because they do not want to deal with the regulatory and compliance hassles – or face the consequences of missing out on a crucial process. A COR puts your mind at ease on all these fronts.

The time savings are not to be ignored either! It is easy to underestimate how much time operational and administrative tasks will really take. With COR services, you can ease the operational burden on your managers, scale up when required – and utilize the time saved to actually focus on your business.

Potential Drawbacks & Considerations

Cost considerations. There is, of course, a fee that your COR provider will charge you – either per contractor per month, or offering bulk packages. This is something you will need to budget for as a part of your contractor management strategy.

While this can certainly be an added cost, businesses that work frequently with contractors find that the cost advantages they get from the efficiencies and time saved often outweigh the COR charges. That said, do watch out for hidden costs like setup fees or termination charges that can take you over your budget!

Added dependencies. Once a COR agreement is signed, the provider will take over your operational responsibilities completely. After this, taking independent decisions on certain things may not be possible.

For example, you cannot just onboard a contractor in that geography without involving the COR – and still have them cover your compliance liabilities. This can sometimes create a bottleneck – especially if the COR is in a different timezone and you have to wait till the next working day to get moving! While this can seem frustrating on the surface, ultimately the COR’s involvement is what helps you stay compliant.

Any good global COR provider should be able to assign a representative for you who will function as your single point of contact. Set up workflows with your representative to ensure seamless communication – be it through recurring catch-up calls at a specific time or asynchronous messages.

Understanding COR Agreements: What You Need to Know Before Signing

Contract Terms & Obligations

COR agreements may differ from provider to provider. While a standard template may be followed, the specific services offered will depend on the provider you choose. Before signing, do go through the contract to make sure it covers all the services you require.

The pricing model is another section of the agreement to pay attention to. Make sure you understand exactly how much you will need to pay and by when. You don’t want any jarring surprises later if you find out that there’s a huge setup fee to get started – or that an essential service comes as an added extra! Involving your legal and HR teams at this stage can be extremely beneficial – they can help ensure there are no glaring loopholes in the agreement.

Exit & Termination Clauses

There’s always a possibility that the Contractor of Record you choose ends up not being the perfect fit for you. Before signing the agreement, find out what the termination clauses are, whether you’ll need to pay anything extra in those circumstances, and how much notice you’ll have to give before ending the contract.

Some CORs charge a yearly fee for their services that incorporate a bulk discount. If you’ve taken advantage of such pricing plans, it may not be possible to get a refund, should you choose to terminate the contract midway.

Intellectual Property & Confidentiality Considerations

A very important factor to consider is how the COR will handle your intellectual property and information. After all, they will be in charge of managing a lot of sensitive data like your workers’ personal details, your company registration number, tax information and more – and it wouldn’t do to have these compromised.

While a COR is responsible for all of these, you do have certain obligations as an employer to ensure data security. So ensure the COR has the right processes and tools in place.

Streamlining processes with COR

The advantages of working with a COR are many – and with the right partner, managing a global contractor workforce becomes a breeze. As with any kind of service engagement, you may have to invest a bit of time and effort initially to do your research, find the provider that’s just right for you and onboard them seamlessly. The COR provider should be able to take it from there and run processes smoothly on your behalf.

Here at TalentDesk, we do offer AOR services specializing in contractor management, giving you complete peace of mind! We take over all freelancer compliance responsibilities – looking after AML and KYC checks and handling all contracts and paperwork for your freelancers across countries. We even sign agreements on your behalf – literally, putting our name on the line! In essence, we function as a protective shield for your business so you can leave your contractor compliance and worker classification decisions completely up to us.

Interested in our Contractor of Record (COR) services?

There on, we run your contractor operations with ease. Our nifty features like digital documentation, e-signing and automated record keeping makes it extremely easy for you to onboard, offboard or scale up as you choose. Additionally, we store all your data securely in the cloud, guaranteeing complete protection and privacy. This means you no longer have to worry about your data getting compromised, or being misplaced at the most inopportune times!

With all the operational and administrative tasks taken care of, all that’s left for you to do is innovate and grow your business!

Sanhita Mukherjee

Speak to us to find out how we can help you stay compliant

Related articles

California’s Freelance Worker Protection Act: What Businesses Need to Know

Learn how California’s Freelance Worker Protection Act (FWPA) impacts your business with compliance requirements, payment rules, and penalties.

Mastering Influencer Management: Strategies for Effective Collaboration

Our guide to influencer management, exploring strategies, tools, and tips to create successful influencer relationships and enhance your marketing impact.

The Hidden Complexities of Independent Contractor Classification

Read the complexities of independent contractor classification in our guide. Stay ahead with expert insights into evolving rules, tools, and future trends.

What are Global Payroll Providers: Understanding Payroll Systems

Explore the essentials of international global payroll, how it supports multinational operations, compliance, and simplifies payroll global processing.

How To Avoid Employee Misclassification

Avoid costly errors by learning about employee misclassification risks, legal ramifications and compliance strategies when classifying your workers.

Work, Reconstructed

Xenios Thrasyvoulou and Glen Hodgson discusses the main compliance issues that are faced today within the talent and HR sectors.

What is an Agent of Record (AOR)?

Read about the essential role of an Agent of Record (AOR) in representing freelancers and contractors globally, ensuring compliance and smooth operations.

Differences Between W9 and W8 Tax Forms

Unravel the purposes of W-8 and W-9 tax forms, download them, understand when and how to use them, and navigate the complexities of US tax compliance effectively.

How to pay 1099 employees

How to pay 1099 employees

Navigate 1099 employee payments and paying 1099 employees with ease. Learn how to ensure timely, compliant compensation for your contractor workforce. ‘

PEO vs. EOR: What's the difference?

Though similar, PEOs and EORs have key differences. Learn the distinctions and find out which is right for your business.