What are Global Payroll Providers: Understanding Payroll Systems

- 19 Apr 2024

- 12 mins read

- Posted in

Content:

There was a time when employers wouldn’t even consider hiring candidates who were not based in the same city as them. Today, global teams are more the norm than the exception.

Employers have realized the advantages of having a workforce spread across the world. It dissolves geographical limitations when hiring top talent. It does away with expensive relocation complexities. The business gets to enjoy global perspectives and the team culture becomes richer and a lot more diverse. With newer collaborative technology, factors like distance and time zone differences are not an issue anymore.

However, there is still one challenge that holds employers back from going global with their workforce – and that’s managing global payroll.

What are Global Payroll Providers?

Global payroll providers simplify the complexities of managing an international workforce by offering centralized solutions for payroll processing, compliance, and payments. They ensure accurate calculations for wages, taxes, and benefits while adhering to local labor laws and tax regulations. Providers also offer tools for multi-currency payments, data security, and integration with HR and finance systems, streamlining operations for businesses expanding globally.

Understanding Global Payroll

The international global payroll process is not as simple as just disbursing a set amount as salaries to employees each month. There are many calculations and considerations to be taken into account. Even for a single employee, you will need to calculate their wages, reconcile it against their time off, pay out the benefits and perks they are entitled to, award any bonuses as applicable and also withhold the necessary amount as taxes.

Global payroll is the centralized system that processes these calculations for workers around the world – and then makes each payment compliantly across different countries.

What Global Payroll Means for Your Business

Any company that is considering a global expansion needs to embrace global payroll first. The first reason for this is that it lets you offer a consistent payroll experience to all your workers, no matter where they are based.

Secondly, it allows you to remain compliant. You cannot simply pay your international workers based on the laws of wherever you are headquartered – you will need to adhere to the labor laws and regulations of the country the worker is based in. Global payroll equips you to handle this.

Thirdly, it offers a great alternative to setting up subsidiaries in each new country you want to hire in. You can simply onboard, work with and pay new talent in different regions, without going through the costly and time-consuming process of establishing an entity there first.

The Basics of Global Payroll Systems

There are several international global payroll systems you can consider based on your business needs now and in the long term.

- Option 1: Manage it in-house.

This is where your internal payroll department handles this function for all the countries you have workers in. Though it gives you more control, it can be time, effort and cost-intensive because you will have to manage all complexities in-house – including compliance protocols in different countries. You may also need to set up global entities, which means further costs and bureaucratic challenges. - Option 2: Decentralized payroll.

Here, you outsource your global payroll functions to individual vendors in each country. This saves you the time, cost and effort of having to manage global payroll in-house. There’s also the added assurance that local vendors will be aware of the compliance protocols in their own country and are likely to manage it well. However, you will need to juggle multiple vendors, and may face a potential lack of transparency and accountability. - Option 3: Centralized global payroll.

Here, you outsource all international payroll processing responsibilities to one partner who manages compliance and carries out seamless payments across countries, through one centralized global payroll software. This lets you enjoy better visibility, offers greater accountability and reduces potential security breaches.

Differences Between Domestic and Global Payroll

You may be wondering why you need global payroll providers at all. If you are already paying local employees, why not use the same payroll system for international workers too?

This is because local payroll has far fewer complexities to consider. Your current system may not account for the differences in labor laws across countries and thus miss out the implications they have on your obligations as an employer – be it minimum wages, employee benefits or insurance payments.

There are logistical factors too. Your local payroll system may not have the capability to handle payments in different currencies or calculate international taxes. The payment method they use may not be available in every country.

A global payroll system will have all these considerations built into it already.

Challenges in Managing Global Payroll

How to Deal with International Employment Laws

For most employers, the biggest challenge of global payroll is staying ahead of the diverse employment laws in different countries.

For example, the minimum wage for workers in Europe is very different from that for workers in Asia. Similarly, you will need to offer your US workers 12 weeks of unpaid maternity leave – but in India, the law requires you to offer 26 weeks of paid maternity leave. Calculations for health insurance, social security payments and more, will also differ. Making global payments requires you to be aware of all these intricacies and implement them.

Handling Taxes Internationally

Keeping up with tax deadlines in one country is challenging enough – let alone that of multiple nations! The tax regimes may not be synchronized in all the locations you have hired in – so this means you will constantly need to stay on top of filing deadlines and important dates.

You will also need to know how to calculate the amount to be withheld for each worker, given that deductibles and taxable amounts vary, not just across countries but also based on individual circumstances. Getting even a single payment wrong can result in hefty fines.

What’s more challenging is that these tax laws are always being updated – so just when you think you are finally on top of it all, the laws may change.

Protecting Personal Information

Payroll information is a gold mine for hackers and identity thieves! Think about it – where else would they find someone’s personal information, bank details and social security numbers, all neatly compiled in one place?

So your payroll system getting hacked would mean all your workers’ data being compromised. This is why payroll information is strictly legislated and controlled by data protection laws – like the General Data Protection Regulation (GDPR) in the UK, the Privacy Amendment in Australia, the Personal Data Protection Bill in India and other equivalents all over the world.

While the end goal of all these laws are the same, the regulatory requirement for each may be vastly different – and as a global employer, your payroll system will need to adhere to all of these in the relevant location.

Handling Money Exchange

Even if you manage all of the above well, there’s still the challenge of actually disbursing the right amounts to workers internationally!

You will need to consider currency exchange rates and fluctuations. You will need to find a suitable payment method based on what works in all the countries you have workers in. International bank transfers can be extremely expensive – and even well-known platforms like PayPal are not operational in every country.

Additionally, you will need to figure out how to pay out benefits like health coverage, dental coverage and wellness benefits, across different countries.

Tech Solutions for Global Payroll

How Payroll Software Helps

A good global payroll software helps you manage all these intricacies, in every country you hire workers in.

An international payroll system should be able to automate wage calculation by tracking time for each employee and calculating their paid and unpaid time off, overtime, reimbursements, bonuses and more. It should also reconcile the benefit obligations you have towards each worker – thus helping you manage employment compliance.

When it comes to taxes, a global payroll system should be able to automate the process – keeping track of relevant filing dates, forms, calculation parameters and so on.

Equally importantly, the software should ensure data protection by storing all your workers’ data in the cloud or in encrypted systems, in a way that’s compliant to the laws of their country.

Finally, it should make payouts on your behalf, in various currencies and in a timely manner, using an optimized payment method.

Connecting Global Payroll to HR and Finance Systems

A global payroll software increases your organizational efficiency by integrating various systems. Typically, payroll, HR and finance teams work in silos – maintaining their own data sets, which may or may not match with one another.

A global payroll software offers a great opportunity to bring all these functions together to offer better visibility, reduce discrepancies and cut down on unnecessary duplications. Aside from day-to-day efficiencies, this also makes monthly reports or year-end audits super simple!

Choosing the Best Global Payroll Option

Now let us look at how to go about choosing the right vendor for your needs. Not every global payroll service will be suitable – but by the time you get to the end of this section, you should have a fair idea of what to look for in your payroll provider.

What to Look for in a Global Payroll Partner

- Identify your requirements. Start by seeing if your shortlisted partners cater to your business needs – if they have a presence in the countries you want to hire in, if they can handle payments in the currencies you need, and if they work well for your team size.

- Explore accountability. Many international payroll providers do not actually have the capability to handle payroll functions in every country themselves – so they outsource it to third-party vendors. If not handled well, this can mean you have to grapple with the inefficiencies of a decentralized system despite paying for a centralized offering. Ensure your provider remains accountable for their operations in every region they serve.

- Check their payroll offerings. Make sure that the offerings provided by your shortlisted partners match all your needs. Aside from global payment capabilities, can they also disburse benefits, manage taxes and handle insurance payouts?

- Explore integration capabilities. Find out if the system can be integrated with your existing HR and Finance functions. Without such seamless integrations, you may only be increasing the complexities of your payroll process – you will need to maintain yet another data set that involves tedious tallying, duplication and rectifying potential errors.

- Ensure ease of use. An ideal system should have a comprehensive, intuitive dashboard that gives you visibility of all your payroll functions across countries at a glance. It should also include an app for workers to view payment receipts, request time off, upload reimbursement requests and more.

- Assess their technology. Find out what kind of technology your shortlisted providers use. The ideal vendor should hit the sweet spot between convenience, innovation and security. For example, a partner that uses new-age AI tools to automate processes and compliments it with blockchain technology for enhanced data security would be a great pick!

- Look at cost transparency. Your ideal provider should fit comfortably within your budget now, and also when keeping your future growth plans in mind. Some providers have hidden costs or huge upgrade fees that make them unfeasible as you scale up; others only make sense if you are managing payroll for a large headcount. So make sure you are aware of the exact costs you will incur.

- Consider support availability. Find out what kind of global payroll support your provider will offer. Will this support be available during your working hours and in your time zone? Will you be assigned a dedicated account manager for your business? Is multilingual support available? Given that you will be paying people around the world, this is a huge bonus!

Different Global Payroll Providers

| Company Name | Description | Best For |

| Rippling | An all-in-one HR services and payroll platform known for automation and customizable workflows. Integrates HR, payroll, and IT services. | Businesses seeking time-saving solutions and extensive integrations for international operations. |

| Oyster | A comprehensive global employment platform offering payroll and HR management services in 180+ countries. Includes talent sourcing and a global employment cost calculator. | Companies looking for a full-service platform covering the entire employee lifecycle. |

| Papaya Global | An international professional employer organization offering payroll services in 160+ countries with a focus on compliance and analytics. | Large companies needing detailed payroll analytics and compliance support. |

| Remote | A global HR platform offering EOR services, payroll, and compliance management. Strong focus on employee support, including relocation and visa sponsorship. | Businesses seeking comprehensive EOR services with robust compliance support. |

| Gusto | An international payroll solution with EOR services. Supports local currency payments, onboarding tools, and user-friendly dashboards. | Companies of all sizes managing distributed workforces, especially with global contractors. |

| Justworks | Justworks is a PEO platform that simplifies HR, payroll, compliance, and benefits management for businesses. | Small to medium-sized businesses seeking an all-in-one HR and payroll solution with access to competitive benefits. |

Benefits of a Smooth Global Payroll System

Making Payroll More Efficient and Accurate

When you choose the right provider, global payments become so much smoother. It ensures you don’t have to worry about payment inaccuracies or delays – no matter where your workers are based.

It gives you the assurance that you are fulfilling all your obligations as an employer, when it comes to employee benefits in different countries. And when it comes to tax, HR and legal compliance, it makes sure you no longer have to rely on manual systems that are prone to errors. The peace of mind you enjoy from having these bases covered, is extraordinary!

Boosting Employee Happiness and Loyalty

A great payroll system makes your global team happier too. They no longer have to wonder about when they are getting paid or why certain deductions were made. With a transparent app or dashboard, they should be able to log in and access all their payment and deduction data easily.

It also enables you to offer similar benefits across geographies. After all, nothing demotivates an employee more than finding out that their peers in other countries enjoy better perks than them.

Making Contractor Payments Super Fast

A fantastic payroll system can also help you pay global contractors with just a click. Depending on the service you select, you may be able to enjoy consolidated invoices, automated multi-country payments and auto-generated audit trails for contractor payments.This is incredibly helpful because even today, many employers do not have formal processes for contractor payments – they are largely handled by individual managers, which leads to all kinds of discrepancies and inconsistencies. A good payroll system helps you streamline this at an organizational level, ensuring you remain compliant and consistent in your contractor engagements too.

Getting Ready for Global Payroll

What to Think About Before Going Global

While a global payroll platform brings many advantages, it is not the right solution in every case, so do consider your future plans for your business first!

For instance – if you are looking at a targeted expansion in a single country, and plan to hire large teams in just that one location, it makes more sense to set up an entity there. Likewise, if you would rather work with international contractors than make full-time hires, an AOR service is a better fit for you. An Agent of Record (AOR) is a third-party entity that helps you hire, onboard and pay freelancers and contractors around the world, compliantly.

However, if you are looking to engage full-time employees as well as freelancers across a large number of countries, a global payroll system would be perfect for you.

How to Switch to a Global Payroll System Successfully

After you’ve considered your specific business requirements and chosen your global payroll system, it’s time to put together a successful implementation plan.- Get stakeholder buy-in. Ensure all your stakeholders are in agreement about the future plans of your business – and that they understand exactly how a global payroll system can help you get closer to those goals.

- Make an inter-department plan. Involve relevant departments in the process of shortlisting and finalizing the global payroll partner. For example, your Finance and HR teams are likely to be able to identify obvious gaps and offer valuable inputs as you create your payroll checklist.

- Get employees on board. Get your employees excited by giving them adequate notice about the change and highlighting all the advantages they can expect with the new system. After all, the payroll system is ultimately for their benefit too.

- Time it right. Execute the system roll-out at a time that works well for the business, avoiding busy periods like the year-end. Also ensure that the implementation is prioritized in countries where you have a larger headcount.

- Ensure ongoing support. Change is difficult, and employees, contractors, and managers may all struggle to navigate the unfamiliar platform, no matter how intuitive it is. Offer adequate training beforehand, and ensure continued availability of demos and real-time support so that the initial excitement doesn’t fall flat after the system is launched!

Working with Independent Contractors Globally

-

Cutting Down on Legal and Financial Issues

Many employers prefer to deal with global payroll challenges by engaging international freelancers and independent contractors rather than making full-time hires. This does indeed, bring lots of legal and financial advantages.

Since these workers are not employees, you have no legal obligations towards them. They will set their own rate, work on their own time and in the way they choose – so you will not need to keep up with laws governing minimum wage requirements or working hours in their country. You also will not need to offer them employee benefits, which means you don’t have to worry about sick leaves, paid time off, maternity policies and more!

Freelancers and contractors pay their own taxes – thus relieving you of the responsibilities of tax withholdings. Additionally, you will not have to consider overtime payments, reimbursements or the added cost of benefits. -

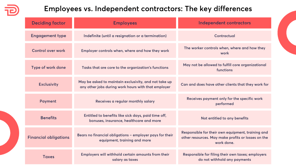

Knowing When to Call Someone a Contractor or Employee

That said, you cannot engage freelancers and contractors and expect them to fulfill the role of a full-time employee. There are laws against this, and in fact, doing so counts as ‘worker misclassification’.

If a contractor or freelancer consistently fulfills a core function of your business, works with you on an open-ended or recurring basis, and you assert a high degree of control over when, where and how they function, the tax and legal authorities would consider them as an employee disguised as a contractor.

They would then require you to actually term these workers as employees and offer them the same protections, benefits and rights that your other employees would get. -

The Importance of Getting Classification Right

Misclassification is not just a matter of what you call your workers – it has immense legal and tax implications. The authorities see this as an employer’s attempt to exploit workers, get away without having to offer them rights and benefits, and avoid paying taxes on workers who should rightfully have been termed as employees.

Employers pulled up for misclassifying workers often have to pay hefty federal fines for labor law violations, as well as compensate the relevant workers with the necessary back pays. The tax authorities may also levy fines for delayed payments and charges for failure to withhold taxes. If the misclassification is found to be intentional and consistent, there may be potential criminal charges too.

All this, combined with the reputational damage that it causes, makes classification compliance too risky to ignore!

Getting global payroll right

This is why, when considering your global talent strategy, it is important to define your specific business requirements in an impartial way and identify which solution will work for you. As we have established, the easy way is not always the right way – and can lead to more issues than advantages.

A good Employer of Record (EOR) or an Agent of Record (AOR) service can help you assess your needs and advise you on the right way to go. Additionally, a good global payroll solution makes it easy for you to make the right choice without having to worry about the operational challenges it may involve.

Sanhita Mukherjee

Speak to us to find out how we can help you pay your global workforce.

Related articles

What is a Contractor Of Record (COR)?

Discover the role of a Contractor of Record (COR) – Learn how a COR streamlines contractor compliance and safeguards your business legally.

California’s Freelance Worker Protection Act: What Businesses Need to Know

Learn how California’s Freelance Worker Protection Act (FWPA) impacts your business with compliance requirements, payment rules, and penalties.

The Hidden Complexities of Independent Contractor Classification

Read the complexities of independent contractor classification in our guide. Stay ahead with expert insights into evolving rules, tools, and future trends.

How To Avoid Employee Misclassification

Avoid costly errors by learning about employee misclassification risks, legal ramifications and compliance strategies when classifying your workers.

Work, Reconstructed

Xenios Thrasyvoulou and Glen Hodgson discusses the main compliance issues that are faced today within the talent and HR sectors.

What is an Agent of Record (AOR)?

Read about the essential role of an Agent of Record (AOR) in representing freelancers and contractors globally, ensuring compliance and smooth operations.

Differences Between W9 and W8 Tax Forms

Unravel the purposes of W-8 and W-9 tax forms, download them, understand when and how to use them, and navigate the complexities of US tax compliance effectively.

How to pay 1099 employees

How to pay 1099 employees

Navigate 1099 employee payments and paying 1099 employees with ease. Learn how to ensure timely, compliant compensation for your contractor workforce. ‘

PEO vs. EOR: What's the difference?

Though similar, PEOs and EORs have key differences. Learn the distinctions and find out which is right for your business.

Freelancing and The Future of Work

Xenios Thrasyvoulou discusses shaking up the employment game, refreshing the tax rulebook, and removing the final hurdles to a super-flexible workforce.